Staffology payroll that integrates with Xero Accounting

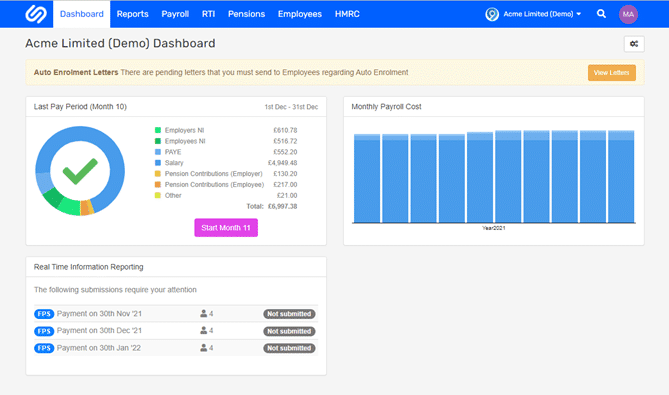

Staffology Payroll Software fully integrates with Xero accounting software, meaning you can use beautiful web-based software for both accounting and payroll.

Staffology Payroll Software fully integrates with Xero accounting software, meaning you can use beautiful web-based software for both accounting and payroll.

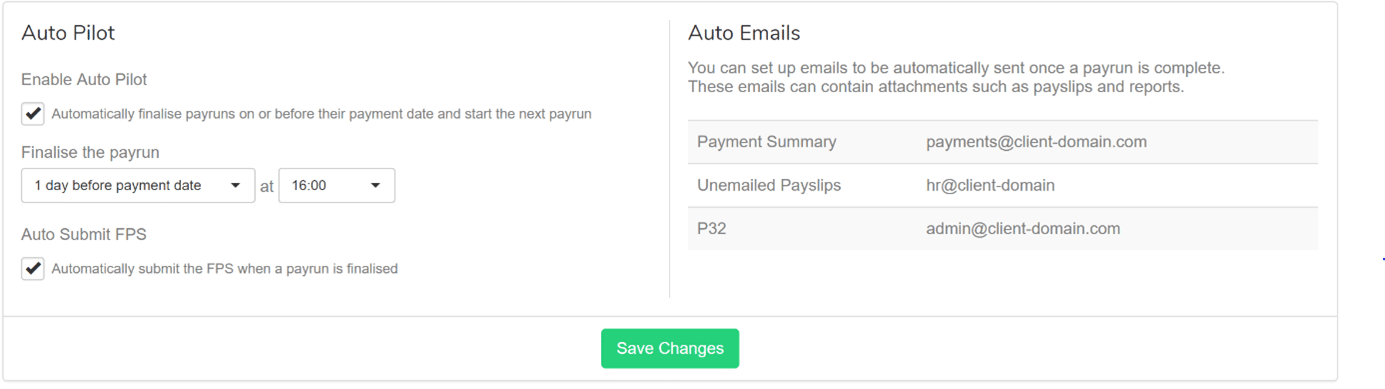

Once set up, the integration is seamless and needs no intervention from you. You can even run your payroll on auto-pilot so that everything is automatic.

Using our payroll software that integrates with Xero, you can benefit from improved efficiencies, reduced time and frustration associated with repetitive or manual tasks, and minimised errors. All of this allows users to focus their efforts on their business.

Staffology payroll integrates with Xero so that you can automatically produce journal entries. You only need to click and connect to Staffology, and then you can map relevant payroll items (such as PAYE or Pensions) to the codes in your accounting software.

For every payrun, a journal posting will automatically appear in Xero.

Using our payroll integration with Xero, you can benefit from the following:

Your Xero account needs to communicate with reliable, compliant payroll software. The Staffology HMRC-recognised payroll is easy to integrate, powered by a comprehensive API that plugs into a range of trusted applications that your business is likely to run.

Learn how to integrate Staffology payroll with your Xero account in only a few clicks.

If you do not already have a Xero account, create one. There is a free trial available.

Create a Staffology account, which is also free up until you want to submit a genuine FPS to HMRC.

To connect your account to Xero, you need to create an employer in Staffology. Either create a real one or follow the on-screen prompts to create a demo company.

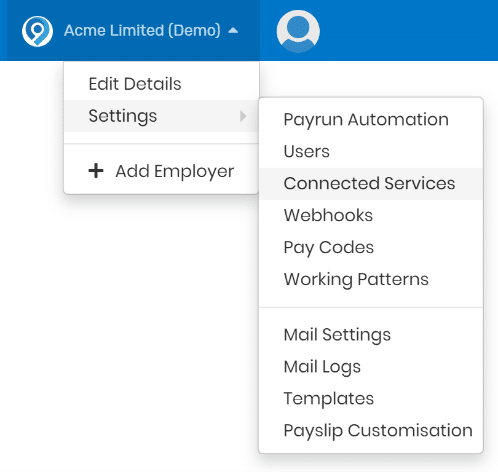

Then select the employer name from the main menu and go to Settings -> Connected Services.

You will see that we connect to a wide range of services. Change to the Accounting tab and select the Xero icon.

After agreeing to give access to your Xero account, it redirects you back to Staffology. You are now connected – that is it!

You only need to do this once.

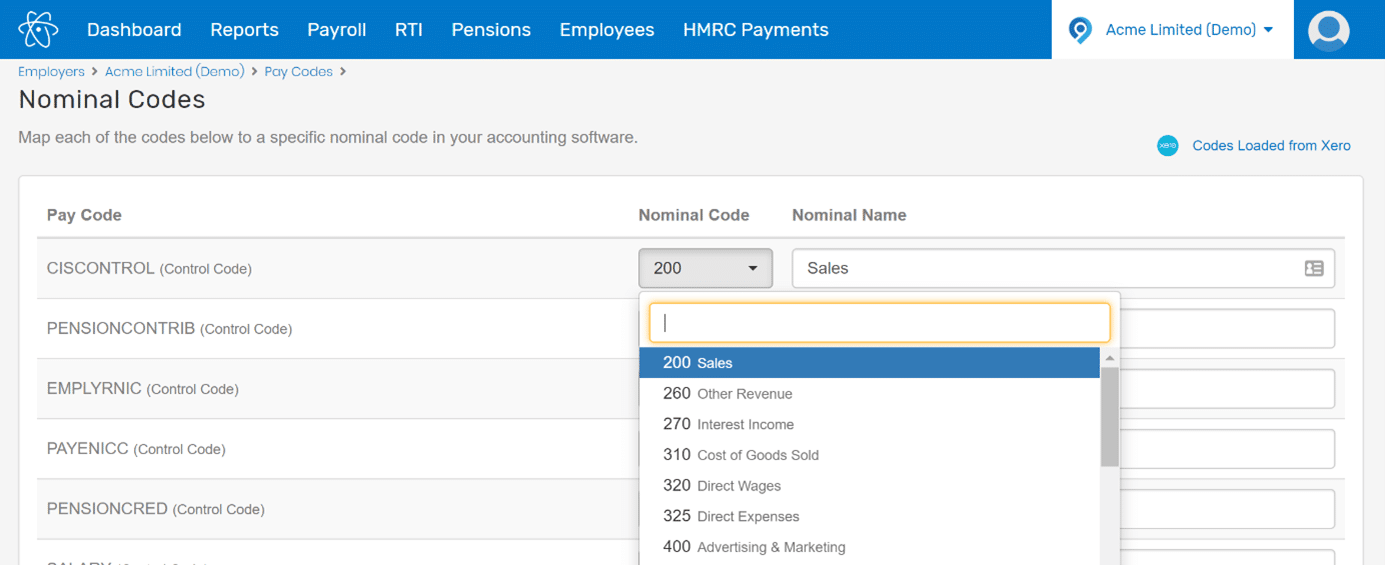

Select the employer’s name from the main menu and choose Settings -> Pay Codes.

Select Nominal Codes and then Load codes from Xero.

We will connect to your Xero account and get a list of your nominal codes. These are then listed in the drop-down lists so you can map a Pay Code in Staffology to the relevant nominal code in Xero.

Once you have mapped everything needed, then select Update Mappings.

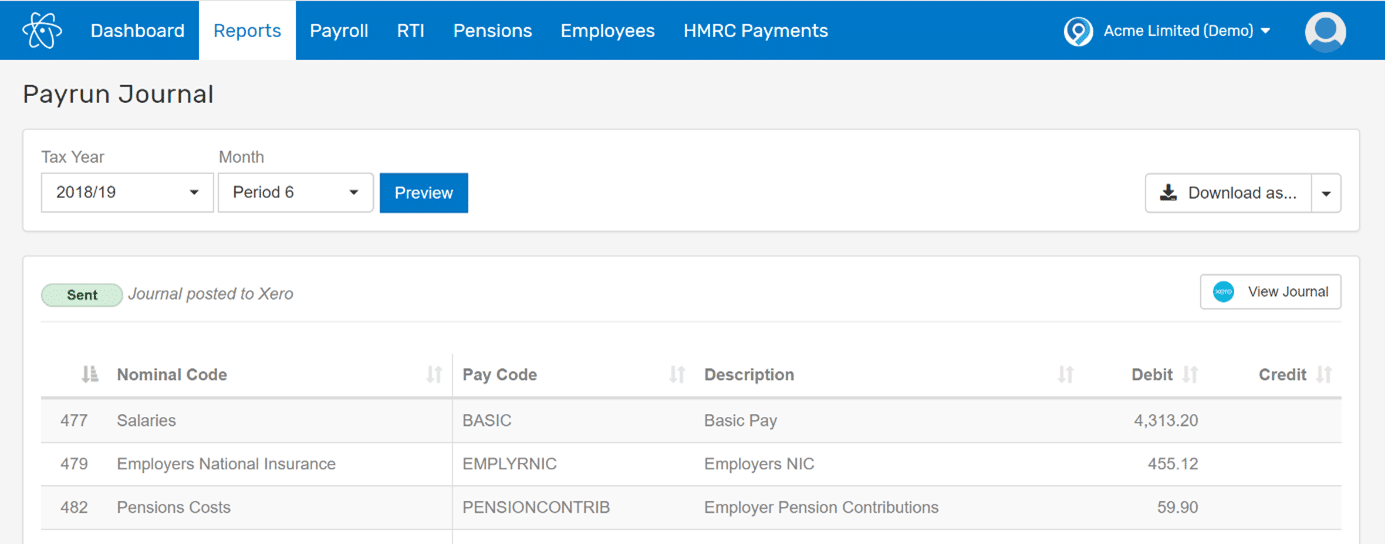

Every time you finalise a payrun, we will automatically create a journal and post it to your Xero account.

You can verify that the journal has been posted by going to Reports -> Payruns -> Journal Entry.

There is also a link here to view the journal entry in Xero.

Now you have automated the creation of journals, see what else you can automate.

Our auto-pilot feature can run a whole year of payrolls without you lifting a finger.

Designed for small businesses, Xero offers recognised and trusted accounting software.

Staffology payroll has been described as intuitive, whereas other payroll software can feel clunky. Rather than run payroll in a silo, why not seamlessly plug in your accounting solution?