A Guide to Calculating Annual Leave Pro-Rata

30th Nov '23

Individuals who acquire work contracts with various clients need to consider how they want to receive pay and arrange their tax and National Insurance deductions. Ways to do this include becoming a limited company, a sole trader, finding an Agency PAYE or using an umbrella payroll company.

Since April 2021, when revisions to off-payroll working rules (IR35) came into effect, more contractors will likely be working under umbrella companies. As this line of work becomes more regulated, having a powerful, reliable payroll solution is critical to ensure that pay is processed compliantly.

We take a closer look at what an umbrella payroll company does and how Staffology payroll software seamlessly integrates with this way of processing pay.

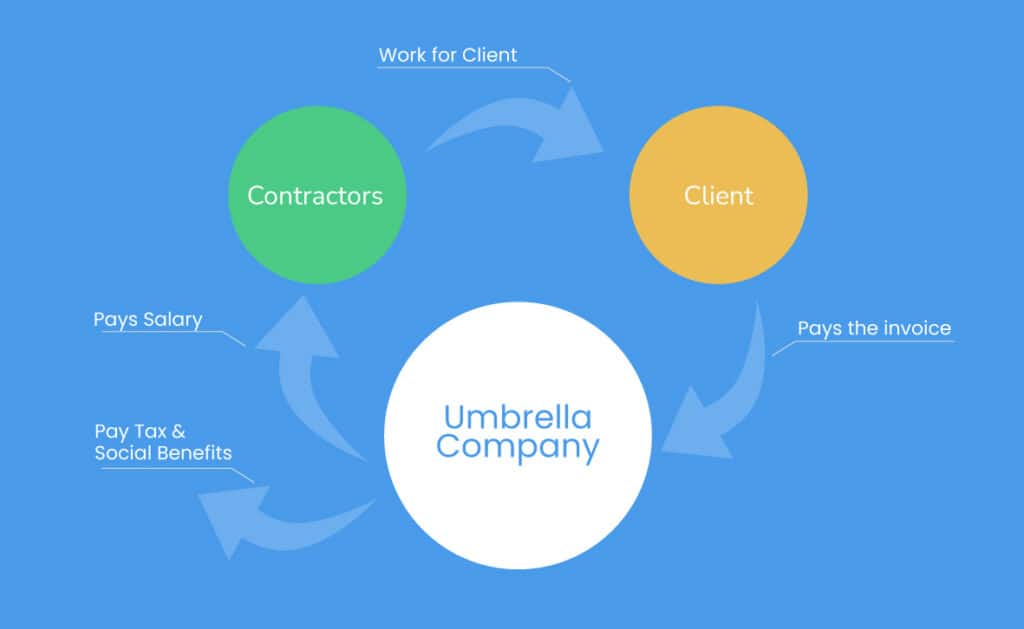

Umbrella payroll is when a third-party company process pay from a client to a contractor. These companies are known as ’umbrella companies’ and often are confused with recruitment agencies. They do work similarly but are not the same.

The purpose of using an umbrella payroll company is to simplify the working relationships and agreements between an employment agency and a contractor, including pay and other administrative aspects, such as arranging deductions for tax and National Insurance to HMRC.

Umbrella payroll companies are used by the following:

When a contractor chooses to enlist the services of an umbrella company, there will likely be some margins involved. It is essential to evaluate these and make sure that this method of processing pay is correct for the individual.

In exchange for these margins, the contractor will have their payroll and tax administration taken care of, and to enable them to work, the company should provide any necessary insurance. Other benefits could also include:

When it comes to umbrella company margins, another important aspect to consider is that because the contractor pays them – rather than the client, the company is on their side. In HR-related circumstances, this can be beneficial should any support be required.

Another popular option for contractors is to use a PAYE agency. These also operate in a similar way to umbrella companies; however, there are several subtle differences that can impact the contractor.

The main difference to note is that an umbrella payroll company effectively becomes the contractor’s employer for the near future. In other words, a contractor may have multiple clients and contracts of varying durations, but their pay is all processed by the same umbrella company. However, this is not the case with an agency PAYE company as they need to be appointed repeatedly with each new contract. There are other differences between an umbrella company and a PAYE agency, including:

Looking at these main differences, it’s clear that choosing the umbrella payroll route has its advantages. When working on a platform that understands a company’s needs, an umbrella payroll solution can make life easier in the following ways:

After communicating all relevant pay information, such as any holiday pay entitlement, apprenticeship levy deductions or even timesheets and other work expenses, an umbrella payroll solution is ready to take care of all calculations for you.

One of the most challenging aspects of running umbrella payroll in the past was the complex calculations. But Staffology’s payroll software features intuitive thinking, designed to eliminate the calculation burden for you. Therefore, this makes more reliable, accurate and transparent calculations – which means quick production of payslips with up-to-date financial information.

With so many expenses to configure, and managing employee and agency pay-related matters, having a solution that simplifies the likes of agency invoices and employee wages in one place is invaluable.

Discover more about how Staffology performs complex calculations, turning them into hassle-free payslips.

If your payroll has the administrative burden of manually inputting employee information, including deductions and expenses, our umbrella payroll solution can help in one of two ways: by connecting to Staffology’s API or importing what you need via CSV file

CSV imports empower you to control what information is driving your payroll outcomes, meaning you have control to specify the data for relevant fields, including invoice values.

Aside from performing calculations and importing relevant data, Staffology’s umbrella payroll unlocks one more critical feature: reporting on your payroll habits. This means umbrella companies can generate and review payroll across a session or period of time for analysis. These reports can be created for internal use or as statements for umbrella clients.

The UK government has regulations in place known as IR35 or off-payroll working rules. These ensure that contractors, who work similarly to employees, pay the same tax and insurance as they would if they were regular employees.

Contractors paid via an umbrella payroll company do not need to worry about the IR35 rules because the company will take care of all tax and National Insurance payments. Likewise, they will not need to complete a tax return form each year, as most self-employed individuals do.

Find out more about IR35 and off-payroll rules.

Staffology provides a cloud-based umbrella payroll featuring an intuitive interface, and our platform is the only one with an API-first application.

The API is at the core of Staffology software. An umbrella payroll company can benefit from our API capabilities, including the option for future scalability (where different applications can communicate) and automation functions.

One of the benefits of using our payroll API is the flexibility to grow and scale how it works for your business. As your company grows, you can scale how you use Staffology by plugging it into other applications, such as accounting software. The API capabilities allow you to push and pull data to and from your Staffology payroll software.

If your development resources are limited, taking advantage of our payroll API may not be something your business can immediately afford. However, with automation as a standard practice, Staffology understands how some payroll tasks can feel like a burden. Payroll often remains the same, meaning you’re paying the same employees routinely. With the help of automation, you can remove the time it takes to regularly perform manual tasks, freeing up how you use your resources. You can even benefit from pay runs being automatically finalised, payslip generation (where employees are emailed payslips), and the FPS will be filed with HMRC.

Umbrella payroll companies are a useful option for a number of contractors who have multiple clients and wish to protect a larger proportion of their income. By choosing Staffology Payroll software to support their payroll processing, umbrella companies in turn support their contractors by ensuring they get paid efficiently and correctly every time. Get in touch to learn more about how Staffology assists umbrella payroll.

Duane Jackson, April 18th, 202230th Nov '23

26th Sep '23