A quick guide to calculating labour turnover

28th Feb '24

Umbrella companies have to do some pretty complex calculations to work out how much to pay an employee.

This sounded like a challenge, so we’ve started building features to make these calculations as easy as 1, 2, 3.

We’ve made a number of assumptions to get started. These include:

With that out of the way, here’s how you can give it a go. You can create a new employer to try this out.

You’ll want to set up three Pay Codes to correctly calculate and track pay.

| Subject to | ||||||

|---|---|---|---|---|---|---|

| Code | Name | Type | NI | Tax | Pension | AEO |

| DPSB | Discretionary Profit Sharing Bonus | Addition | ||||

| HDAY | Holiday Pay | Addition | ||||

| EXP | Expenses | Addition |

Add your employees as usual. The calculations that we automate for you will work with any combination of pay period (Weekly, Monthly, etc), any NI Table and Tax Code, and any pension configuration.

Now to enable the feature.

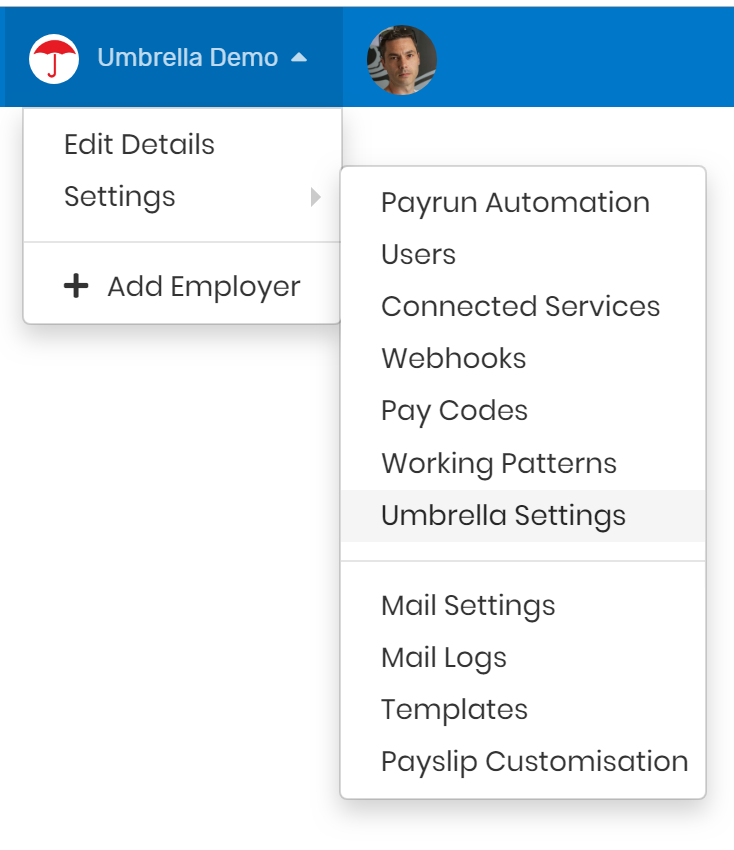

Click the employer name in the main menu, go to Settings and choose Umbrella Settings

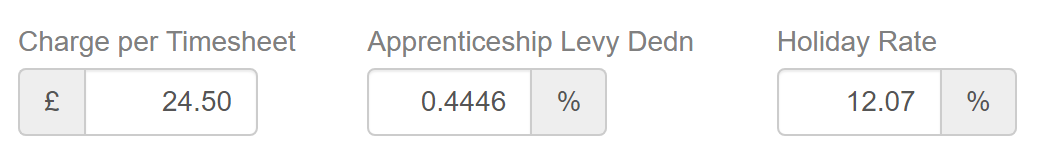

From here you can set how much you charge per timesheet processed and set the percentages for the Apprenticeship Levy Deduction and for Holiday Pay.

You should also set the relevant mappings for each of the Pay Codes you set up earlier.

Start a pay run as usual. Click on any of the employees in the list and click the icon at the bottom-left of the window.

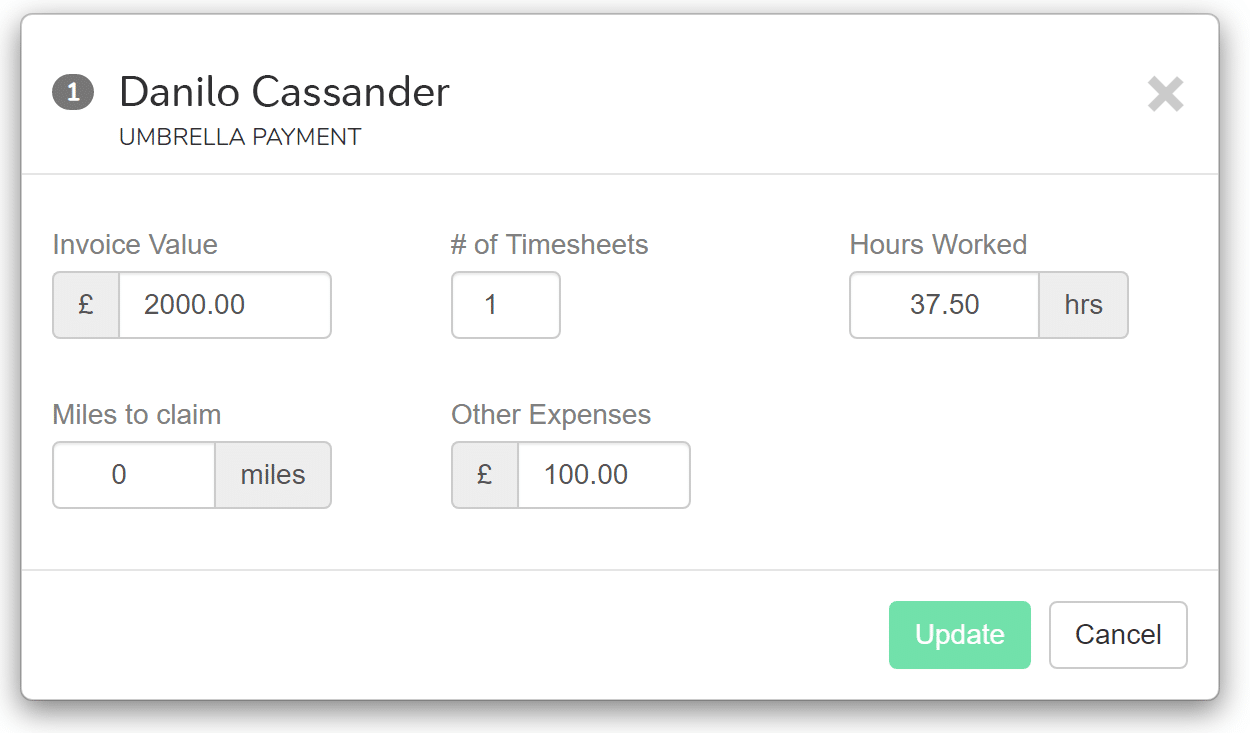

You now just fill in the form.

The fields should be pretty self-explanatory.

The “Miles to claim” only appears if you’ve assigned a vehicle to the employee.

Click “Update”.

This is the bit where others we’ve shown it to say “But…..it…how?”, and then grab a calculator.

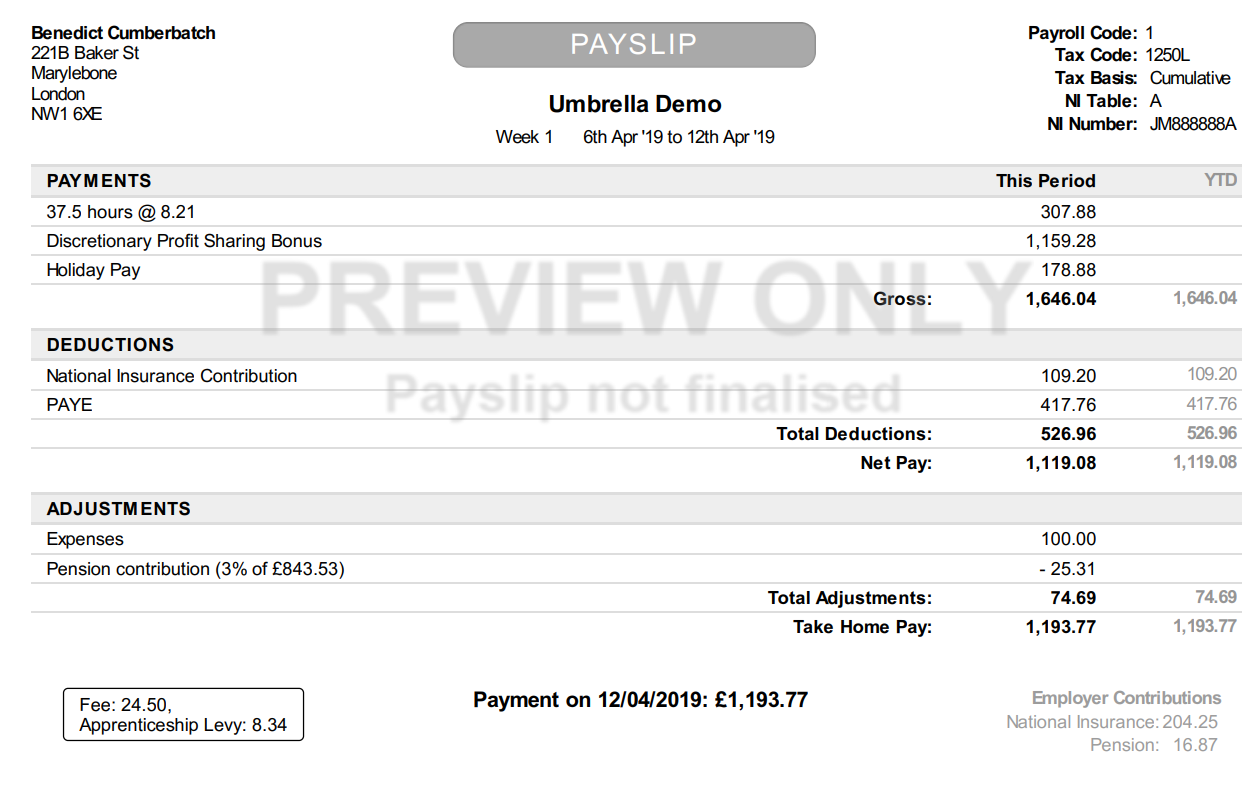

The Payslip is instantly worked out for you.

Let’s take a look at the payslip and check the figures to see for ourselves how it all adds up.

| Timesheets Charge | (1 @ 24.50) | 24.50 |

| Apprenticeship Levy | 8.34 | |

| Take Home Pay | 1,193.77 | |

| Employee Pension | 25.31 | |

| PAYE | 417.76 | |

| Employee NIC | 109.20 | |

| Employer NIC | 204.25 | |

| Employer Pension | 16.87 | |

| Total: | £2,000.00 |

In this example £2,000 was charged to the agency.

The Umbrella Company has deducted their fee and the Apprenticeship Levy contribution.

The remainder perfectly covers the employees pay and the cost of employing them (Employers NIC and Employers Pension).

The employees pay is done in the most efficient way given the hours worked and expenses claimed.

It’s not shown in this example but if mileage was claimed then this would have been worked out at the appropriate rate and the YTD total tracked.

We’d love to develop this further and save you using cumbersome spreadsheets and many (wo)man-hours doing calculations and copy+pasting.

Does it work for your Umbrella company? Are there additional steps or settings you’d need added?

Please do get in touch and let us know.

Duane Jackson, August 27th, 201928th Feb '24

2nd May '23