A Guide to Calculating Annual Leave Pro-Rata

30th Nov '23

Can you believe we are already in month 3 of the tax year 2022/2023 – how quickly does time fly? Below we detail some new features recently added to the software.

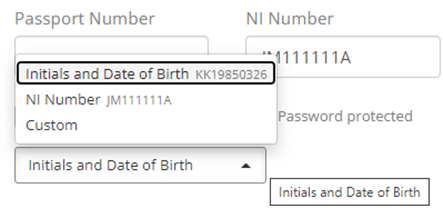

Under Employee > Basic Details, we have added NI Number to the password options when sending payslips by email and using Password protected.

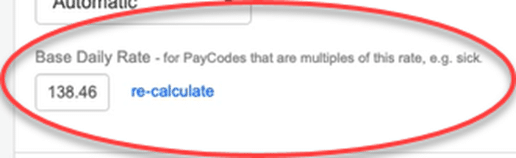

After setting up the relevant Pay Code, a new Base Daily Rate displays on the Employees > Pay Options > Regular Pay tab.

For Pay Codes that are multiples of this rate, such as sickness, you can then use this in the pay run.

The daily rate calculates based on the working pattern of the employee.

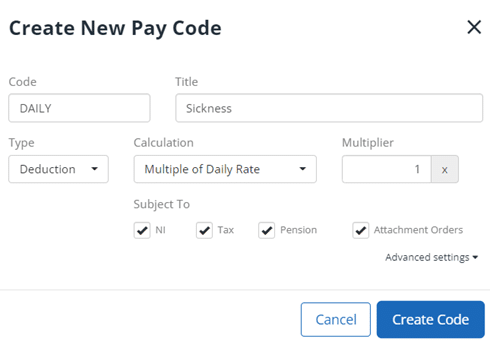

To configure a Pay Code for Base Daily Rate for a sickness deduction, for example:

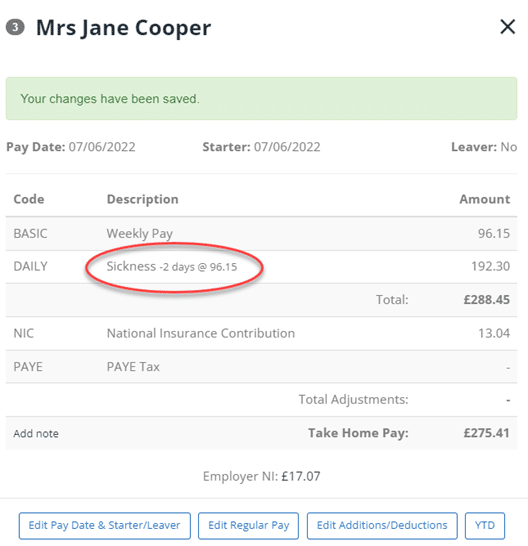

To use the Base Daily Rate in the Pay run:

Now available in the software are two NI Letters Validation reports, one accessed from Reports> Employees and one from Reports > Payruns.

Accessed from Reports then Employees, the report checks that NI letters for all employees are valid on the date printed.

The report includes Code, Name, NI Number, Gender, DoB, NI Letter and Error Description.

Selected from Reports then Payruns, the NI Letter Validation Report is based on Schedule type and pay period.

You can run it for all pay schedules and pay periods, as well as historically, and for the following pay period (only if previous pay runs are closed).

Again, the report includes Code, Name, NI Number, Gender, DOB, NI Letter, Error Description, and Suggested Letter.

When adding a department to an employee during an open payroll, the Summary > Employee Analysis report now populates with the department it previously omitted.

Anna Stephens, June 8th, 202230th Nov '23

26th Sep '23