A quick guide to calculating labour turnover

28th Feb '24

Not as exciting or magical as last weeks new feature, but just as important.

We’re now making it really easy to pay your employees for business miles driven in their own vehicle.

You can pay employees per mile driven, and as long as it’s at or below a certain amount approved by HMRC then it’s tax-free and doesn’t need to be reported.

For the most common vehicle type, cars, the amount per mile decreases after the first 1,000 miles paid in any tax year.

You can now just enter the number of miles to pay for and we’ll make sure they\re paid the correct amount.

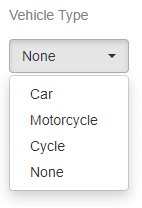

First you need to tell us what type of vehicle the employee is using.

Just go to the employee record, click on the ‘Pay Options’ tab and the ‘Other’ section.

You’ll see an option to select the vehicle type.

Select the relevant option.

Now just run your payruns as usual.

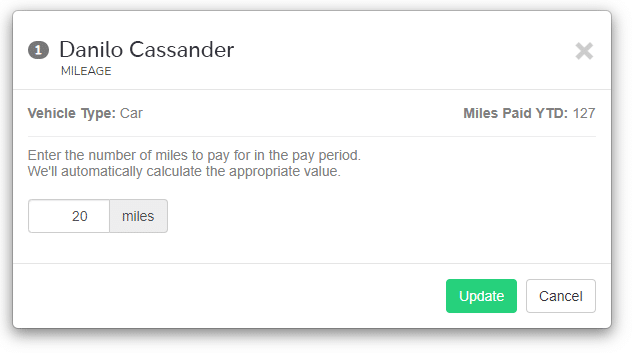

If you click on an employee in the list of payments you’ll see a link labeled “Add mileage”.

Click it and you’ll be presented with a form to enter the number of miles to pay the employee for.

We’ll add a line to the payslip to pay the relevant amount dependent on the vehicle selected and the number of miles already paid for so far this tax year.

And as you’d expect we’ll automatically add a line the journal that’s posted to your accounting software.

We hope this will make your life a little easier. More new features heading this way very soon!

Duane Jackson, August 20th, 201928th Feb '24

2nd May '23