A quick guide to calculating labour turnover

28th Feb '24

We’re starting to get a lot of enquiries about the ability of our software to handle payroll for IR35 and Off-Payroll Workers.

We upgraded our software last year ready for the expected launch in April 2020 – so we’ve been ready for this for a while.

As HMRC delayed in the introduction to April 2021 we’ve taken the opportunity to enhance the software even further for those of you that will be running IR35 payroll.

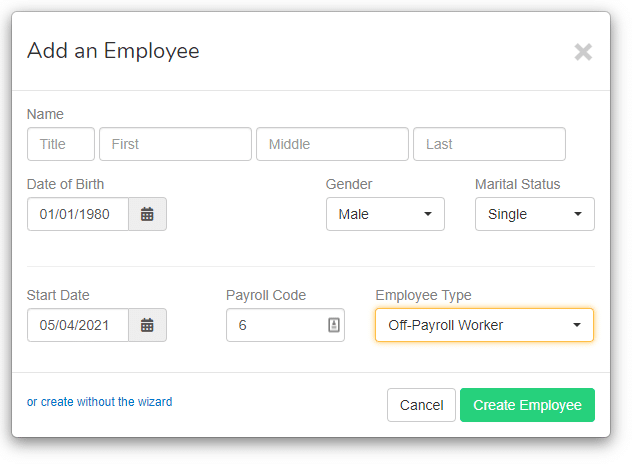

We’ve added “Off-Payroll Worker” as an option when using the wizard to create a new employee.

This will help set the relevant fields for when the payment is reported to HMRC, as well as defaulting to the BR tax code. And next time you add a new employee it’ll default to the option you previously used.

Off-Payroll workers are much simpler to manage PAYE for than standard employees.

There are no benefits, pensions or statutory pay to worry about.

So we’ve removed some of the tabs related to these options if you view an employee that is set as an off-payroll worker. This should keep everything streamlined for you.

We’ve introduced a whole load of validation rules to catch out potential mistakes.

So for example if you try and update an employee record for an off-payroll worker and set a Student Loan deduction then the system will point out the error of your ways.

I expect the consensus will be that it’s best to have a separate PAYE scheme for Off Payroll workers.

But you can mix them in with your regular employees on the same payroll. Our software supports that.

This is the bit that seems to worry most people that are new to payroll.

But it’s really very simple. We’ll automatically send an FPS to HMRC for you every time you finalise a payrun.

Read more about these features on our payroll for IR35 features page.

Duane Jackson, October 29th, 202028th Feb '24

2nd May '23