A quick guide to calculating labour turnover

28th Feb '24

We’ve just released a new report to help you make a claim for a furlough payment under the UK Coronavirus Job Retention Scheme.

We’ll walk you through the process here. It’s quite likely that HMRC will update the guidance on how we should be making calculations so we will update our system accordingly.

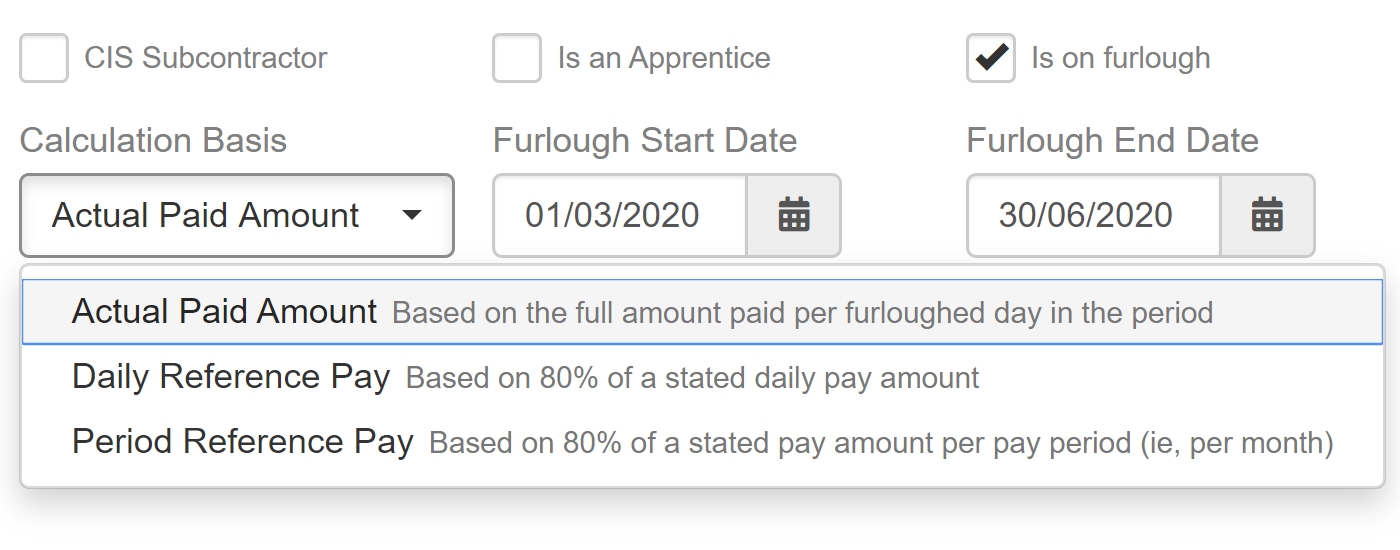

Ensure you’ve ticked the box to say the employee is furloughed.

This is found under the Employment tab of the employees record.

Once ticked you’ll see other fields appear.

As well as the start and end dates for the furlough you can also set a ‘Calculation Basis’.

Actual Paid Amount: You would use this option if you’ve already reduced the employees actual pay to 80% of what it should be.

Daily Reference Pay: You can calculate a daily reference pay amount according to HMRC guidelines. Your claim will be for 80% of that amount for each day the employee is on furlough.

Period Reference Pay: You can calculate a period (ie, monthly, four-weekly) reference pay amount according to HMRC guidelines. Your claim will be 80% of that amount for the pay period. We automatically pro-rata where needed.

HMRC have said you should only be making a claim when you have actually paid your employees or are about to. So our claim report is based on individual payruns.

As well as finalised payruns you are also able to run the report on open payruns before they are finalised.

The report is found under the Reports tab and then the ‘Payruns’ sub tab.

Select a Pay Period and then click the Preview button to see the report on-screen.

As with most of our reports you can download this as a PDF or a CSV file.

At the time of writing (17th April 2020), HMRC haven’t provided any information on how software vendors can submit the claim for you like we do with FPS and other RTI documents.

If and when this becomes available we’ll be making use of it.

What HMRC have said is that you’ll be able to upload a CSV to the portal they’ll be making available “by the end of April” and told us what fields are needed.

As such, the CSV version of the report should give you all you need to make a manual submission via the portal.

HMRC have moved very quickly to get the claim portal available and to work out the specifics of how this all needs to be calculated.

Even as we were about to release this report this afternoon we received details from HMRC about some changes that were being made to the specification.

And, of course, it’s possible we’ve made mistakes in our implementation.

So with that in mind please do check the results of our calculations prior to submitting them and let us know of any discrepancies you find.

As you’d expect, this report is available via the API.

We’ll also be updating the report and calculations based on any new information provided by HMRC over the coming weeks.

It’s been a hard few weeks for everyone in payroll-land, hopefully this report makes things a little bit easier for everyone!

Duane Jackson, April 17th, 202028th Feb '24

2nd May '23