A quick guide to calculating labour turnover

28th Feb '24

Part of the support being provided by the government due to the COVID-19 outbreak has an impact on payroll.

Specifically furloughing of employees and SSP being paid from the first day of sickness.

HMRC haven’t yet given any guidance on how it will reimburse employees for these costs, but we’re taking steps now to ensure that the correct data is being recorded so that once it’s been finalised you don’t face any additional administrative burden to make your claim

First click on your profile image at the top-right of the screen, click Edit Profile

Tick the box to enable the COVID-19 features so that the options we’ll detail below are visible

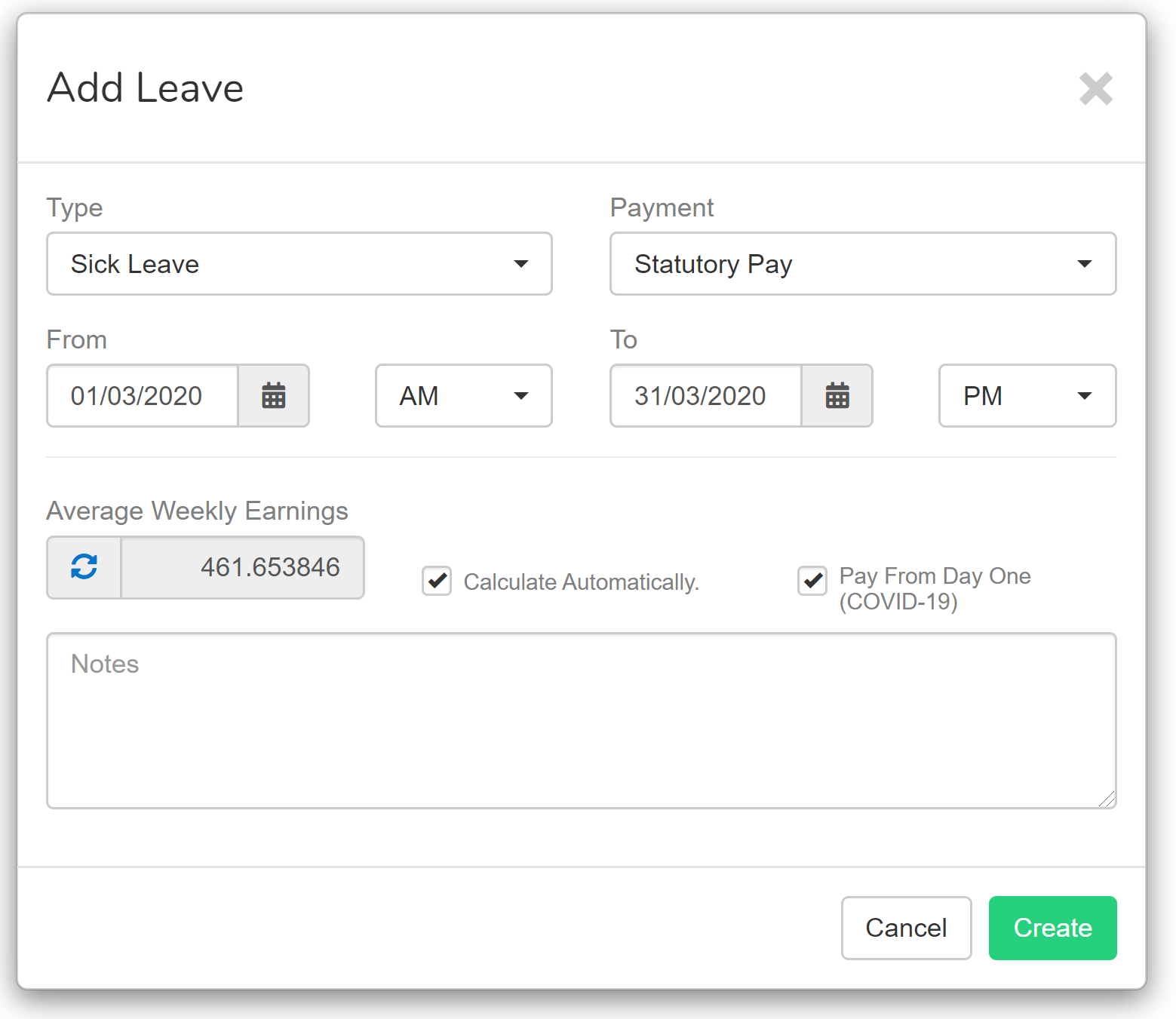

Normally Statutory Sick Pay is paid as from the first working day after 3 ‘Qualifying Days’.

When you record SSP you’ll now see an extra tick box labeled “Pay From Day One (COVID-19)”.

This overrides the default settings and will force SSP to be paid from day one.

Edit an employee, go to the Employment Details tab and tick the box to say the employee is on furlough.

All this will do at the moment is put a flag against any payments made to this employee so that, in the future once it becomes clear what needs to be done, it will be easy for us to produce a report for you containing the relevant data.

Hopefully these small changes will make dealing with the payroll burden a little easier in these stressful times.

Duane Jackson, March 26th, 202028th Feb '24

2nd May '23